How the World's Biggest Digital Bank Redefines Profitable Hypergrowth

127M customers, $4.2B revenue (+39% YoY), $783M net income. How Nubank achieves scale with superior unit economics.

127M customers, $4.2B revenue (+39% YoY), $783M net income. How Nubank achieves scale with superior unit economics.

Subscribe now for best practices, research reports, and more.

Most financial institutions face a trade-off: scale at the expense of profitability, or profitability at the expense of scale. Nubank just proved it is false. In Q3 2025, Nubank reported $783 million in net income (31% return on equity) whilst growing customers 16% year-over-year to 127 million. Revenue grew 39% year-over-year to $4.2 billion with 43.5% gross margins and 27.7% efficiency ratio. This is fundamental reshaping of fintech economics.

What institutional leaders gain:

Traditional banks built on scarcity (limited branches, limited technology) create inflexible cost structures. Venture-backed fintechs assumed abundance but burned cash subsidising growth. Neither achieved both scale and profitability simultaneously.

Nubank solved this by inverting the equation: disciplined unit economics ($0.90 cost to serve per customer per month, $13.4 monthly ARPAC +20% YoY) enable growth velocity without proportional expense increase.

Pillar One: Unit Economics as Moat

Cost to serve: $0.90 per customer per month. Monthly ARPAC: $13.4 (+20% YoY). Activity rate: 83%. This unit economics ratio enables customer acquisition through organic channels without subsidy.

Competitive advantages:

Result: Hypergrowth without cash burn.

Pillar Two: Platform Expansion Drives Operating Leverage

Full-stack approach (deposits $38.8B, lending $30.4B, payments, insurance) enables cross-sell and deepening engagement without proportional acquisition cost.

Competitive advantages:

Result: Revenue grows faster than cost, compounding profitability.

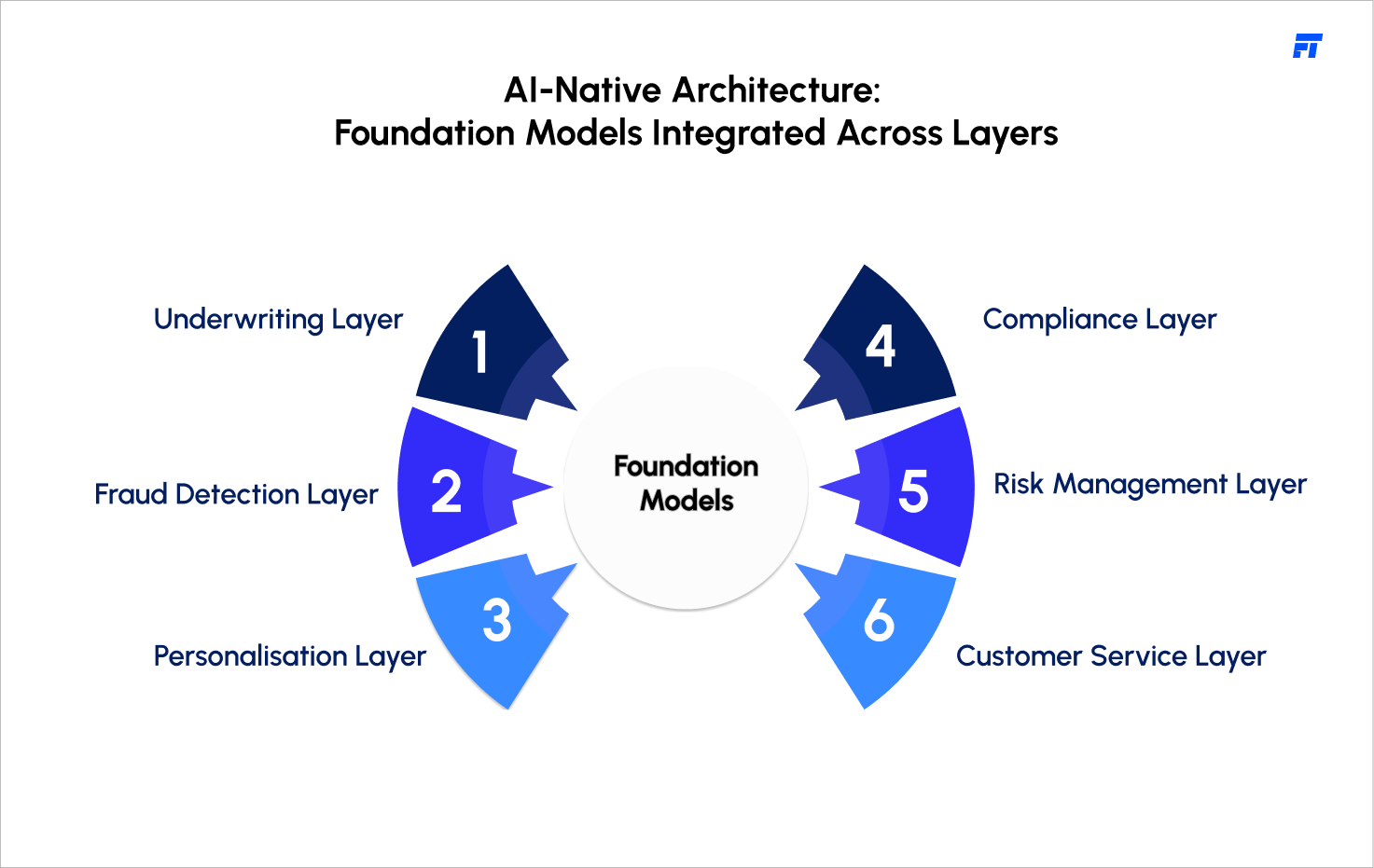

Pillar Three: AI-Powered Risk Enabling Inclusion

Traditional credit excludes thin-file customers (no credit history). AI-powered infrastructure enables behavioural-based decisions, expanding addressable market. Loan book grew 42% year-over-year to $30.4 billion with disciplined credit quality (15-90 day NPL at 4.2%, improving quarter-over-quarter).

Competitive advantages:

Result: Credit expansion without proportional risk increase.

Operating resilience: Diversified revenue and multi-geography presence create stability against market shocks.

Innovation velocity: Cloud-native architecture enables product launches in weeks rather than quarters.

Competitive positioning: Unit economics superiority enables pricing power and customer experience leadership simultaneously.

Customer lifetime value: Increases with product adoption (platform approach) rather than declining over time.

Long-term optionality: Profitability enables self-funding growth without external capital dilution.

Regulatory advantage: Profitability funds compliance and fraud prevention investments that unprofitable competitors cannot afford.

Nubank's results illustrate a fundamental principle: institutional architecture precedes strategy. No amount of strategic optimisation overcomes architectural limitations. Fragmented technology, vendor lock-in, and manual processes cannot achieve Nubank's unit economics.

Conversely, cloud-native, modular, vendor-agnostic architecture provides flexibility to pursue multiple strategies (aggressive growth, profitability optimisation, market diversification) with optionality that architecturally constrained competitors lack.

Institutions that modernise infrastructure without creating vendor lock-in gain the flexibility to pursue Nubank-style growth strategies. Those depending on proprietary platforms face constraints limiting their optionality.

Nubank's Q3 2025 results represent a turning point. The narrative that growth and profitability are mutually exclusive is obsolete. Institutions built on sound unit economics, platform architecture, and advanced risk infrastructure achieve simultaneous hypergrowth and record profitability.

This has implications for competitors (match execution or lose share), incumbents (modernise or become obsolete), and investors (prioritise revenue growth with expanding margins, not growth alone).

The fintech landscape is changing. Winners combine scale with efficiency, growth with profitability, and ambition with discipline. Nubank's Q3 2025 results demonstrate this is not theoretical it is operational reality.

Ready to explore how Fyscal Technologies can help you achieve this?